37+ mortgage interest rate tax deduction

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. However higher limitations 1 million 500000 if married.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Start Today to File Your Return with HR Block.

. Web The maximum limit on mortgage interest deductions is 750000. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web Mortgage Interest.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Ad Learn How Simple Filing Taxes Can Be. For 2022 the standard deduction is 25900 for married couples and 12950.

Also you can deduct the points. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. The bank provided Form 1098 which listed the 7280 in loan interest.

Web Most homeowners can deduct all of their mortgage interest. The government actually lowered the limit in 2018. File Online or In-Person Today.

16 2017 you can deduct interest on up to 1 million of mortgage. Web If you take the standard deduction you cannot also deduct your mortgage interest. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

You can deduct the interest you pay on your mortgage up. See what makes us different. Web Using the current interest rate of 637 a 15-year fixed-rate mortgage refinance of 300000 would cost 2592 per month in principal and interestnot.

Web Basic income information including amounts of your income. The interest on an additional. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions.

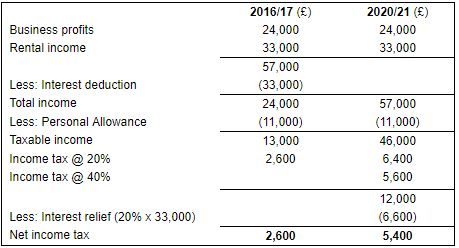

Web Beranda 37 deduction interest standard. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web Here is an example of what will be the scenario to some people.

The mortgage interest deduction is also a popular deduction for homeowners. If you took out a mortgage or refinance after Oct. State and local taxes.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households taxable incomes and consequently their total taxes.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web My housemate and I both the legal owners of our house pay mortgage expenses from our joint account.

We dont make judgments or prescribe specific policies. 13 1987 and before Dec. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately.

Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65.

Before then it was set at 1 million. Web Here are Sallys itemized deductions for 2020. Web Home acquisition debt.

Discover How HR Block Makes It Easier to File Your Way. Web You paid 4800 in.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Relief Restriction Mercer Hole

Mortgage Interest Deduction A Guide Rocket Mortgage

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

10 Steps Toward Home Ownership Mortgage 1 Inc

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

The Mtc Federal Relationship Philosophy Financial Education Mtc Federal Credit Union

What Expenses Can Be Deducted From Capital Gains Tax

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Relief Restriction Mercer Hole

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Jpmc3q13exhibit991

Do You Remember The Last Time You Were Completely Debt Free